|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

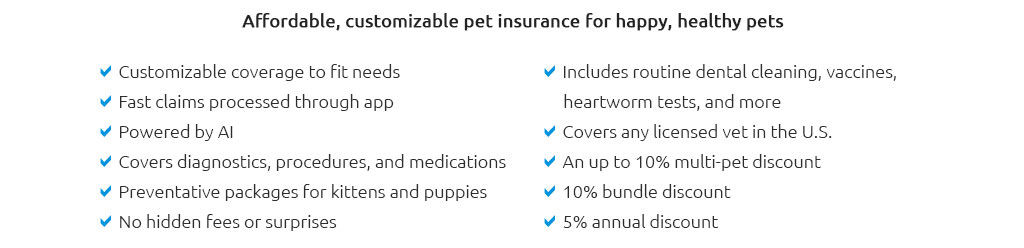

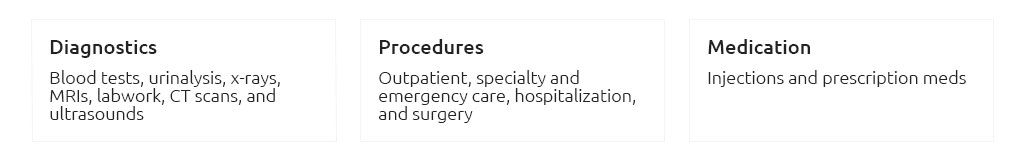

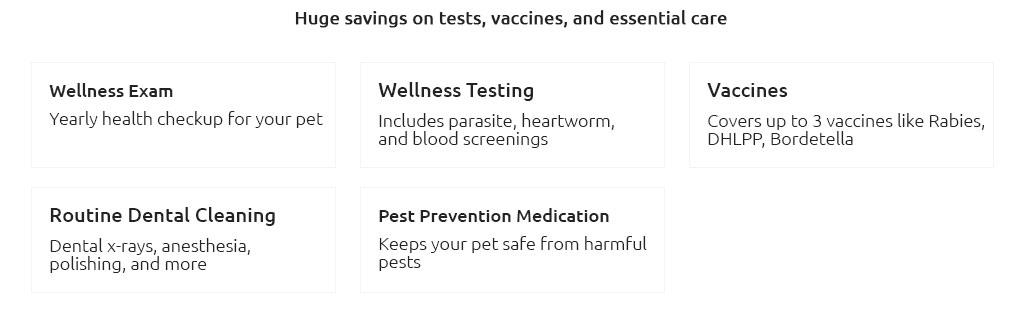

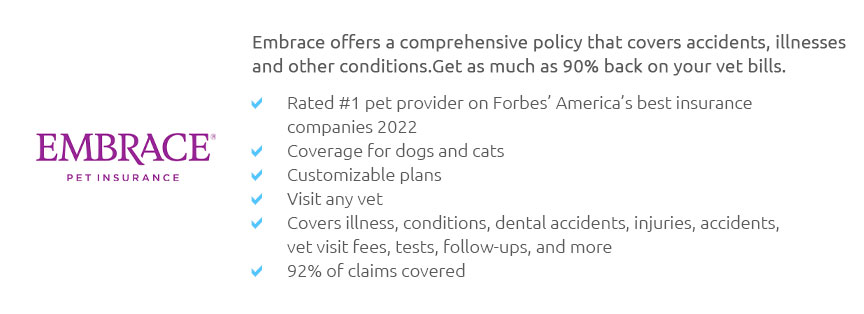

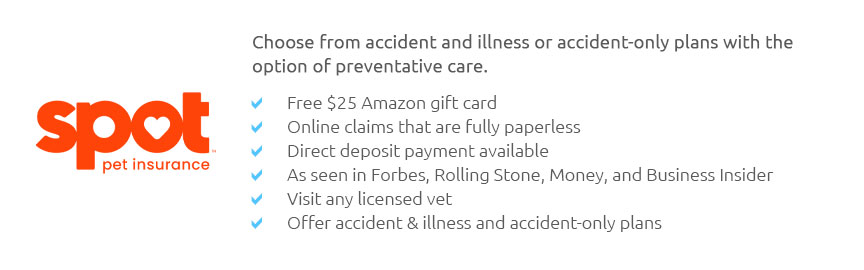

The Ins and Outs of Pet Insurance: A Comprehensive ExplorationIn recent years, pet insurance has emerged as a compelling option for pet owners seeking to safeguard their beloved companions against the unpredictable nature of life. As veterinary care advances and the costs associated with it rise, many are considering pet insurance not merely as a luxury, but as a prudent measure to ensure that their furry friends receive the best possible care when they need it most. This exploration delves into the intricacies of pet insurance, offering insights into its benefits, potential drawbacks, and what prospective policyholders should consider before making a decision. Understanding Pet Insurance involves grasping the fundamental concept that it operates similarly to human health insurance. Policyholders pay a monthly or annual premium, and in return, they receive coverage for a range of veterinary services, depending on the specifics of their plan. These can include routine check-ups, emergency procedures, surgeries, and in some cases, even alternative therapies such as acupuncture or chiropractic care. The scope of coverage varies widely among providers, making it imperative for pet owners to scrutinize the terms and conditions of each policy carefully. One of the primary benefits of pet insurance is the peace of mind it offers. Knowing that one is financially prepared for unexpected medical expenses can alleviate the stress that often accompanies pet ownership. Moreover, with the rapid advancement in veterinary medicine, treatments that were once inaccessible due to cost are now within reach, thanks to comprehensive insurance plans. For instance, the availability of cutting-edge procedures like MRI scans or complex surgeries becomes feasible with the right coverage, potentially saving the lives of pets who otherwise might not receive such care. However, it is crucial to approach pet insurance with a critical eye. Not all policies are created equal, and the fine print can sometimes reveal exclusions that might catch policyholders off guard. Pre-existing conditions, breed-specific issues, and age-related ailments are often not covered, which can lead to unexpected out-of-pocket expenses. Additionally, some policies operate on a reimbursement basis, meaning that pet owners must initially cover the costs themselves and then submit a claim to the insurer. This can be a financial burden if the treatment is costly. When considering pet insurance, one should evaluate the specific needs of their pet. Factors such as age, breed, and overall health can influence the type of coverage that is most suitable. For instance, younger pets might benefit from accident and illness plans, while older animals might require more comprehensive coverage that includes wellness visits and chronic condition management. Conducting a thorough comparison of available plans and reading reviews from other pet owners can provide valuable insights into the reliability and customer service quality of different insurers.

In conclusion, pet insurance is an invaluable tool for those committed to providing the highest standard of care for their pets. While it requires a thoughtful assessment of various plans and an understanding of one's financial capabilities, the benefits it offers can be substantial. By investing in the right policy, pet owners can ensure that their companions lead long, healthy, and happy lives, free from the constraints of financial uncertainty. As more people recognize the role pets play as integral members of the family, pet insurance is likely to become an increasingly common and respected component of responsible pet ownership. https://www.petinsurance.com/

The best pet insurance ever by Nationwide. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. https://www.lemonade.com/pet

America's top-rated insurance, now for cats and dogs. Lemonade has earned 4.9 stars in the App store, and is also top-rated by Supermoney, Clearsurance, and ... https://www.aspcapetinsurance.com/

We're committed to providing reliable, affordable, and trustworthy coverage so our pets can live happier, healthier, longer lives.

|